With news of a possible housing market crash circulating, it’s understandable why more than two thirds of Americans feel concerned. However, the current data shows that today’s market is much healthier than before 2008 when there was a major collapse in the US economy. Therefore, if you’re looking to buy or sell property soon – take comfort knowing this time could be quite different from what occurred over 10 years ago!

Mortgage Standards Were Less Strict

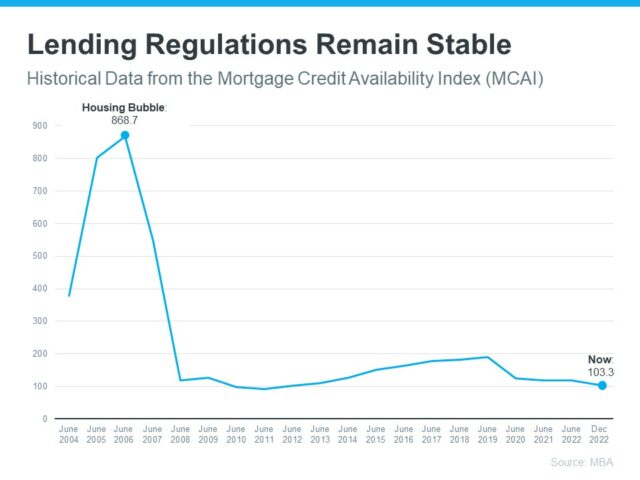

The per-crisis housing market was a tale of two extremes. On one hand, banks were making it increasingly easy for borrowers to get their dream home with little effort or documentation—but fast forward only months later and the mortgages those same people had taken out soon became nightmares as defaults began flooding in due to risky lending practices by these institutions. But today’s climate sees much stricter standards set by lenders who are looking at more than just credit scores when deciding if someone is eligible for a loan, meaning borrowers can rest assured that they won’t find themselves over leveraged like so many did before them – something which we can see clearly demonstrated on this graph from the Mortgage Bankers Association (MBA).

This graph paints a striking picture of just how much more cautious lenders have become since the economic crash. Stricter credit standards mean that we are far less likely to experience another wave of foreclosures like before, helping protect individuals and families from financial hardship.

Foreclosure Volume Has Declined a Lot since the Crash

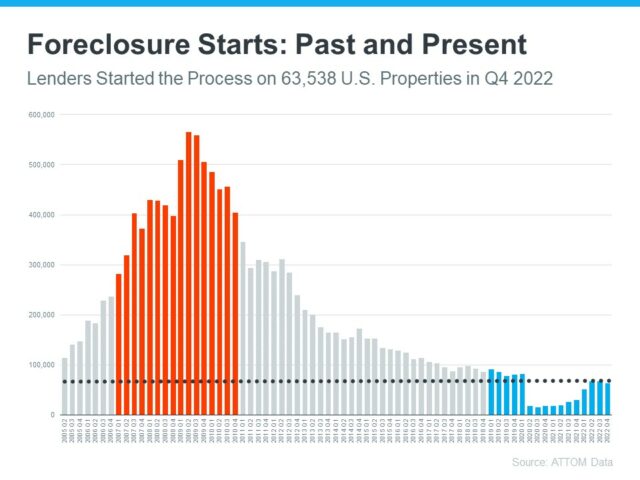

While the housing bubble burst a decade ago and entailed an alarming amount of foreclosures, today’s buyers are more dependable and likely to stay current on their loans. According to data from ATTOM, this has resulted in significantly fewer foreclosure events since then – as seen by the graph below:

In spite of a slight uptick in foreclosures, the rate remains very low. Unlike after 2008’s crash, when home prices plummeted due to widespread foreclosure levels, experts anticipate that any increase this time will likely not be drastic, thanks to Bill McBride at Calculated Risk for shedding light on such an action and its effects.

“The bottom line is there will be an increase in foreclosures over the next year (from record level lows), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

The supply of homes for sale today is more limited.

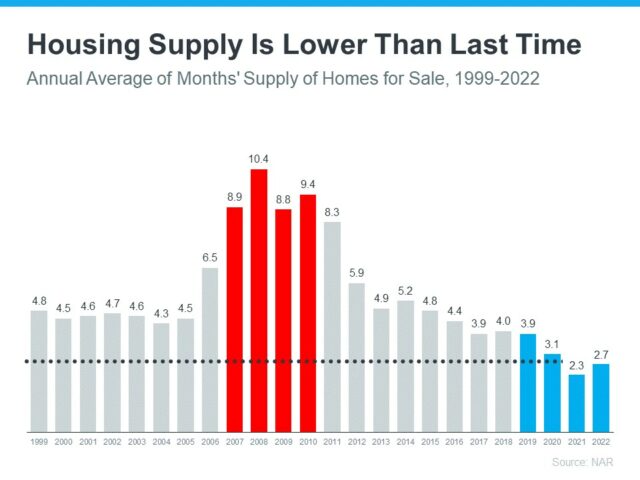

Despite the relative increase in homes available for sale, housing inventory is still in short supply. This shortage can be attributed to years below building levels required by growing demand. According to data from the National Association of Realtors (NAR), unsold inventory remains at a mere 2.7-month’s supply, which is significantly lower than that seen during 2006 market crash and unlikely to lead to similar extreme price declines this time around – though some areas may experience slight dips in value due to their previous overheated markets.

Bottom Line

The anxiety surrounding housing market trends may be at an all-time high, but the facts tell a different story. Experience and analysis indicate that today’s real estate climate is substantially more stable than it was during the last decade’s crash – so breathe easy!